The Latest Industrial Control Chip Supplier Spot Delivery Period And Price Trend

According to the latest observations, from the beginning of 2023, the industry growth rate from heaven to purgatory. Perhaps, for industrial control chip manufacturers, a new round of shuffle has just begun?

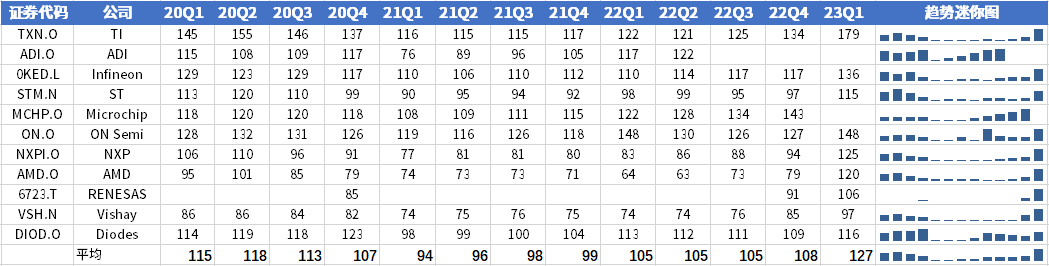

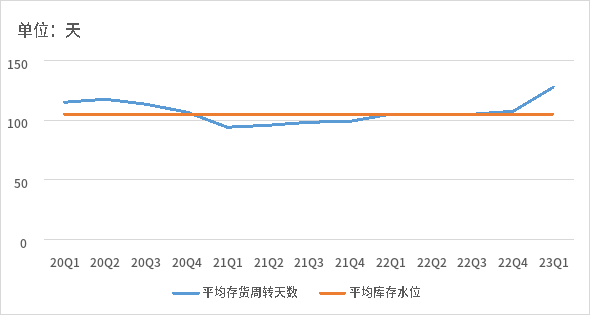

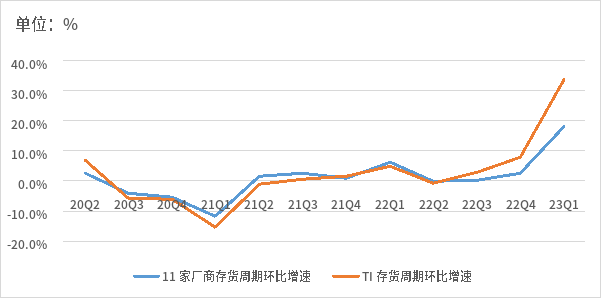

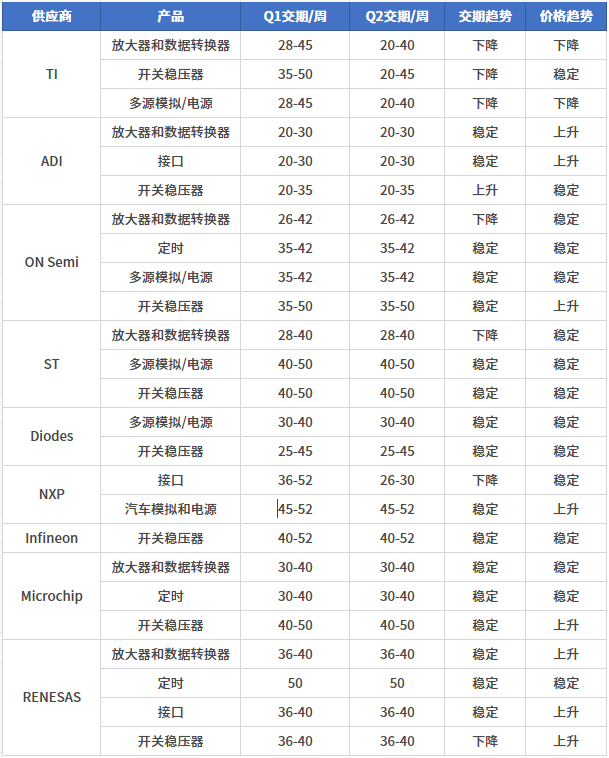

Inventory: TI leadership, industrial control chip inventory of innovative high According to the financial report of the head manufacturers of 11 Global Global Control Chip, since 2022Q2, the average inventory of the industrial control chip has shown an upward trend. The increase in inventory in inventory since the end of last year shows that the current global industrial control industry has entered the inventory adjustment stage.Taking the leading manufacturer TI as an example, the number of days of inventory increased from 134 days of 2022Q4 to 179 days of 2023Q1, which is much higher than its conventional inventory water level at 90-110 days. Chart: The inventory of the inventory of 11 industry -controlled chip manufacturers worldwide changes (unit: day) Source of data: Wind, annual reports of each company, Core Eight Brother Specifically, the average inventory of industrial control chip manufacturers has reached 127 days, with a conventional inventory aqualm line of more than 85-100 days.Obviously, since last year, the industrial control industry has expanded greater than the demand, the risk of inventory increased, and the industry's prosperity declined. Chart: The average inventory turnover of 11 Global Gongzhong -controlled chip manufacturers (units: day) Source of data: Wind, annual reports of each company, Core Eight Brother From the perspective of the average growth rate of the inventory cycle of 11 workers control chip manufacturers and the comparison of TI data, 2022Q4 is the node of the industry's rise in inventory. The current industry is still in the rise of inventory.Determination. Chart: The average growth rate of the inventory cycle of global industrial control chip manufacturers in the past Source: Core Eight Brother Compilation Dating: Simulation/ MCU down, FPGA upward 1. MCU: The overall downward situation is obvious On the whole, the analogy and price decline of industrial control/general -purpose MCU products are obvious in the 2023Q2, and most of the products have continued to improve, and the price returns to normal. From the data from TI, ST, Infineon, Microchip, NXP, and RENESAS, the 8 -bit MCU and 32 -bit MCUs have shortened the trend, and the price has gradually tended to normal prices.However, the automotive series MCU supply is still limited. Chart: 2023Q2 Main Industrial Control/GM MCU manufacturer's delivery date and price trend Source of data: Fuchang Electronics, annual reports of various enterprises, and core eight brothers 2. Simulation: Industry or fall into a price war Affected by the weak end demand, the price of industrial control PMIC and other categories have gradually returned. TI recently opened a price war in Taiwan and mainland China in China, and once unveiled a new situation in the market control product market. Specifically, TI's PMIC products 2021-2022 were once the spot market price increase star products, but most of the current industrial-grade PMICs have shortened the date, and the market price has gradually returned to normal levels.For example, PMIC represented by TPS53513RVER, etc., has fallen from the peak thousand yuan level to now around 10 yuan.In general, the current price of PMIC is still a certain high price, and the industry is estimated that there is still much room for price in the second half of the year. Chart: 2023Q2 Main Industrial Control/General Simulation Products Enterprise Payment and Price Trends Source of data: Fuchang Electronics, annual reports of various enterprises, and core eight brothers 3. FPGA: Improve the price high in the date As one of the typical application products of the industrial control market, FPGA has improved from the dating of head manufacturers. The shortest shortened to about 20 weeks, but the price floats relatively small, and the overall high level is maintained under demand growth.Taking the leading manufacturer AMD (Xilinx) as an example, although the SPARTAN 6 series of the SPARTAN 6 series has improved in the first half of the year, the price increase is still as high as 8%-25%. In the case of the terminal without alternative products, customers are willing to accept futures quotes. Chart: 2023Q2 Main Industrial Control FPGA Products Enterprise Duration and Price Trends Source of data: Enterprise annual reports, Fuchang Electronics, and Xinjiao Brother

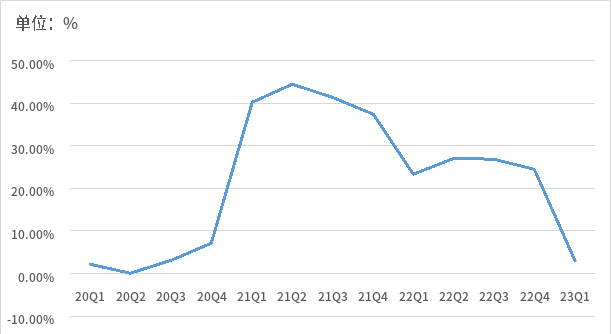

The expansion of revenue ended, the survival of the fittest In summary, the revenue data of the 11th Global Global Global Control of the Global Global Control, 2020Q4-2022Q1 is the peak of the performance of the manufacturer of the industrial control industry.Entering the trough, the downward situation is obvious.This may be the market simulation chip price led by the industry leader in China in May, and the root cause of the inner volume is added. Chart: 2020Q1-2023Q1 Headorgian control manufacturer's revenue of the average growth rate of revenue Source: WIND, Core Eight Brother Compilation In the short term, demand is the key to the continuous development of the current industrial control manufacturers.From the main application market analysis of industrial control, the demand for traditional industries such as petrochemical, logistics and metal processing has slowed down, consumer electronics is difficult to return to its peak, the automotive industry is in a changing stage, and the release of new capacity of stacking and controlling chip industries.Quarterly) MCU and simulated industrial control products demand/price may continue to decline. In the long run, with the rise of new energy sources such as lithium battery, photovoltaic, and energy storage, the demand for new capacity brought by electric vehicles, the recovery of the macroeconomic environment, and the Q4 industrial control chip industry may be warm.